Many years ago, at a posh resort on the left side of Costa Rica, I golfed among the monkeys and alligators with a man who told me the secret to success. This man was in his mid-30s, good looking, wore a shiny Rolex, and dressed in the expensive golf fashion of the time.

“Christian,” he said, as he whipped his driver in big practice swings in the tee box, “the secret to success is debt.”

“All of those bullshit stories they run in Fortune, Forbes magazines about paying off debt early or not going into debt at all are completely wrong.

“Oh, and by the way, those magazines are written by indebted journalism majors with zero business experience…

“When I got out of college, I moved to New York and took on as much debt as the bank and credit cards would let me. I rented a nice apartment, bought an expensive suit and this Submariner,” he added, shaking his watch at me.

“You must have had a nice trust fund,” I replied.

“Far from it. My dad sold cars. I went to a state school.

“The question is how did I pay for it. Well, I went to work. I had a degree in advertising and shopped my resume everywhere. I worked freelance at night — sometimes for free — until I gained traction in the business and then kept on working, doing everything I could to make money and get ahead.

“By the time I looked up a few years later, I had a couple of nationwide beer accounts, a great wife, kids in private school, and a beach house on the Jersey Shore…

“Debt was the motivation of my success. It was an all-in commitment. I was either going to get rich or go bankrupt. Plus, wearing a $2,000 suit changes how you and those around you play the game.”

Debt, in my friend’s case, was the answer to success.

It also works on the national level. We owe the idea of national debt, like so much, to the English.

In the late 1690s, the British suffered through wars and revolution, bad kings and devastating battles with the Dutch.

In 1690, the British Navy was defeated by the French in the Battle of Beachy Head. Without the Navy, British trade suffered, and the economy was in shambles.

England needed 1.2 million pounds to rebuild its fleet, but its coffers were empty. So it came up with an ingenious idea: Instead of stealing the money from the people in the form of taxes, it would borrow it and pay 8% for good measure.

In 1694, the governor and company of the Bank of England was incorporated and given exclusive access to the government’s balance sheets and exclusive rights to issue banknotes. Lenders exchanged bullion for banknotes, and the necessary funds were raised in just 12 days.

A new Royal Navy was built, which led to early industrialization of transport systems and metalworking. This Navy protected and expanded trade routes, which in turn brought in more money.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Building an Empire

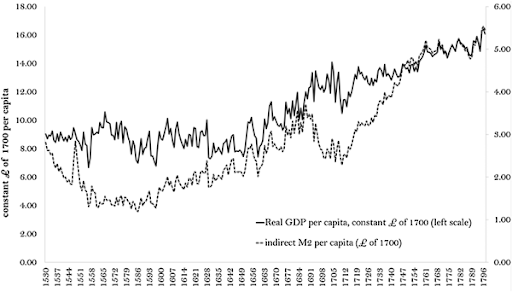

You can see the bottom of the English economy in 1700 and then a constant expansion for the next 100 years, though it really didn’t take off until 1820 or so.

All Things in Moderation

It was the creation of national debt that allowed England to punch well above its weight and build a global empire. But at some point, debt becomes too much. When you can’t pay it back, it starts to become a problem.

But whose problem is it, the borrower or the lender? Next week, we’ll hear some stories of woe — when debt goes bad.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.